Many tax-exempt organizations are speaking out about what happens in their legislature. Charities are allowed to be active and speak out. Whether locally or in Washington, legislators have a significant impact on charities’ programs and the populations charities serve. Activism can be tricky when it crosses over into lobbying, an activity subject to restrictions imposed by the IRS.

Questions

In order to obtain tax-exempt status, charities cannot spend a substantial part of their activities attempting to influence legislation (aka lobbying). This means charities are allowed to lobby, but only an insubstantial amount. But what is or is not lobbying? Can an exempt organization escape the lobbying limitation if it opposes an Executive Order? What if the charity urges its supporters to call their senators to oppose a cabinet nominee? Can a charity support the organization of a march that supports its charitable mission?

The Rule

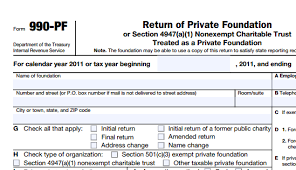

A charity can engage in advocacy around its core causes, but has to be cautious when its advocacy places the charity in the position of supporting or opposing legislation or nominees. The IRS prohibits organizations exempt under section 501(c)(3) from being organized or operated as “action” organizations. Generally this prohibition requires exempt organizations to spend an insubstantial amount of time and resources to lobbying. Unfortunately, there is no clear definition of “substantial” or “insubstantial” in the eyes of the IRS. So while a charity may lobby, the line between the safe amount of advocacy and too much lobbying can sometimes be hard to draw. The rules are stricter for private foundations – any time or resources spent on lobbying or political activity by a private foundation is considered a taxable expenditure.

Some types of lobbying are easy to identify. If a charity contacts their senator or representative to urge a vote in favor or against a particular bill, the charity is engaged in direct lobbying. If the charity encourages its supporters to take action in favor or against a particular piece of legislation, the charity is engaged in grass roots lobbying. Direct and grass roots lobbying are subject to the IRS’s rules on lobbying.

Cabinet and Judicial Nominations

A picture of a protest in Union Square, New York, NY. (Credit: commons.wikipedia.org)

At first glance, a cabinet or judicial nomination might not seem like “legislation.” Charities might think they are allowed to contact their legislators about nominees, or urge supporters to do so, without considering those activities as lobbying. But under long-standing guidance, the IRS considers a legislature’s advice and consent on the nomination process for cabinet appointees and federal judges to fall within the definition of “legislation.” Therefore, if a charity attempts to sway a legislator in favor or against a cabinet or judicial appointee (either directly or via public opinion), the charity is engaged in lobbying. In the case of a private foundation, such lobbying will trigger a tax liability.

Executive Orders

An Executive Order, on the other hand, is outside the legislative process. A charity can attempt to rally support for or opposition against an Executive Order without triggering the restriction on lobbying so long as it does not urge lawmakers to pass new legislation in response to the order. This applies equally to public charities and private foundations.

Marches & Rallies

In recent weeks numerous high-profile marches and rallies were organized around the country in support of or opposition to a number of causes. Some were in response to particular actions by the Executive Branch, while others were organized to support women’s rights, immigrants’ rights, or refugees’ rights. Where a march furthers a charity’s exempt purpose it is not lobbying. Consider a pro-environment march organized by a charity whose mission involves protecting the environment – the expenditures by the charity will further the charity’s mission, and are entirely appropriate. So long as a march or rally is not in support of or opposition to legislation, or a particular candidate for political office, the charity’s activities will not be subject to the lobbying or political action restrictions imposed by the IRS. As noted above, a march or rally in response to an Executive Order would not be considered lobbying, since an Executive Order is not legislation.

We Lobbied or We Want to Lobby– Now What?

If a 501(c)(3) already lobbied, or it wishes to lobby in the future, there are a few steps the organization should take. The first is to set up accounting and bookkeeping procedures that ensure all expenditures on lobbying activity are clearly accounted for. A public charity may choose to make a 501(h) election which will provide a fixed limit on what the charity can spend on lobbying. While the 501(h) election imposes a limit, it also acts as a safe harbor – the charity knows exactly how much it can spend on lobbying activity. Under 501(h), a charity may use up to 20% of the first $500,000 of its exempt-purpose expenditures to lobby – the limit increases depending on the size of the charity’s expenditures on charitable activities.

Charities should note that the 501(h) election only applies to the money spent on lobbying activities. If the charity has very cost effective methods of lobbying (such as rallying support on social media), it will be able to engage in a significant amount of lobbying activity.

A public charity also has the option to forego the 501(h) election. The charity would then be subject to the “insubstantial part test.” The test examines whether the charity’s lobbying activities are “substantial” or “insubstantial”, the vague standard set by the IRS.

Get Help

In today’s political climate, many charities find themselves confronting challenging questions regarding lobbying and political activity. While some of these questions have straightforward answers, others require careful consideration. A charity’s decisions around lobbying and political activity have potentially significant consequences, ranging from possible taxes to loss of exemption. If you have any questions regarding lobbying or political activity, consultation with a legal professional may be a good idea.

-

Perlman & Perlmanhttps://www.staging-perlmanandperlman.com/author/nancyisrael/

-

Perlman & Perlmanhttps://www.staging-perlmanandperlman.com/author/nancyisrael/

-

Perlman & Perlmanhttps://www.staging-perlmanandperlman.com/author/nancyisrael/

-

Perlman & Perlmanhttps://www.staging-perlmanandperlman.com/author/nancyisrael/